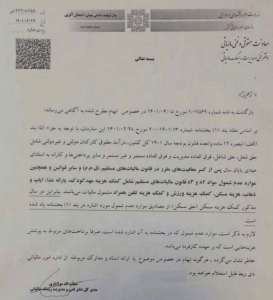

پThe opinion of the technical and tax risk management office regarding the non-inclusion of housing right tax

The opinion of the technical office and tax risk management regarding the non-inclusion of housing right tax:

According to the announcement dated 29/4/1401 of the Director General of the Technical and Risk Management Office of the Tax Affairs Organization, housing allowance (housing rights) is exempt from tax.

It should be mentioned that according to the 5th paragraph of Note 12 of this year’s budget law, job rights, employee rights, management supernumeraries, continuous and non-continuous supernumeraries, and similar items are subject to tax deduction.

This is despite the fact that things like kindergarten allowance, food subsidy, commuting expenses, housing expenses, sports allowances and mobile phone allowances are not taxable.